How do I add taxes to my event?

Last Updated: Dec 9, 2021 09:56AM PST

Due to US Marketplace Facilitator sales tax regulations, Events.com will automatically calculate, collect, file and remit sales tax revenue on behalf of our US Event Organizers.

For tax automated Event Organizers, it will be necessary to select tax categories for your tickets/registrations and purchases. For Event Organizers outside of the US, you can customize your tax settings in the Pre-Registration Settings.

If you have any questions, please contact us for more information help@events.com

Automated Tax Setup

For Registrations/Tickets:

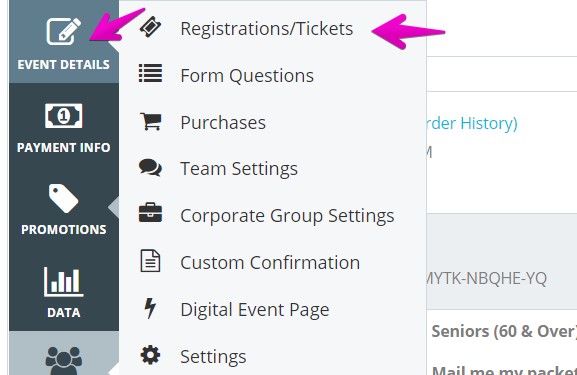

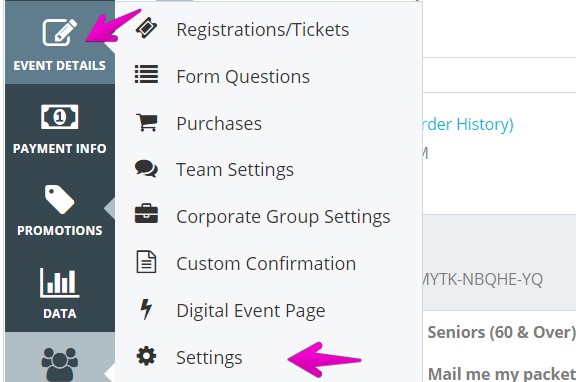

1. While in your event, go to EVENT DETAILS in your event navigation (left side), and then Registrations/Tickets

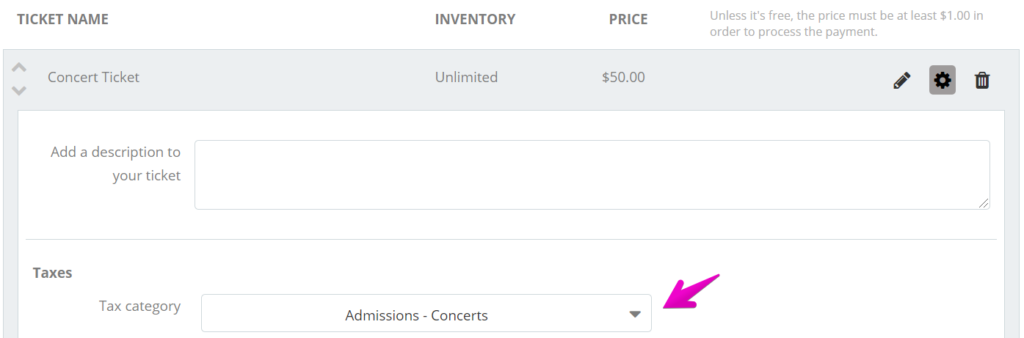

2. Fill in the registration/tickets fields, and then open the Advanced Settings by clicking on the gear icon to select your Tax Category. *for extra description and examples of the tax categories, please refer to the Tax Category Chart below.

3. SAVE all changes.

For Purchases:

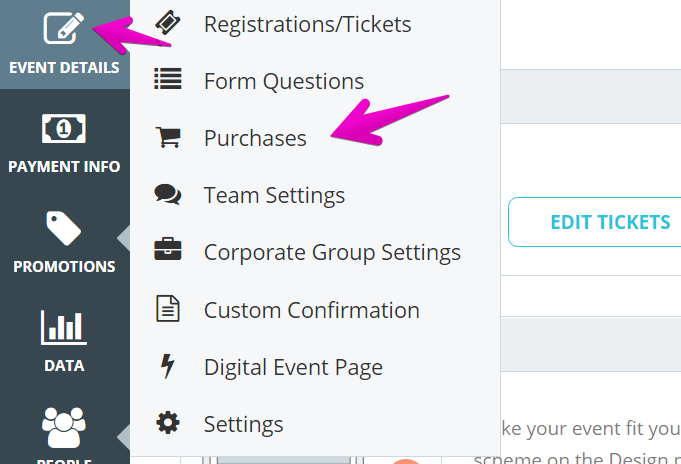

1. While in your event, go to EVENT DETAILS in your event navigation (left side), and then Purchases

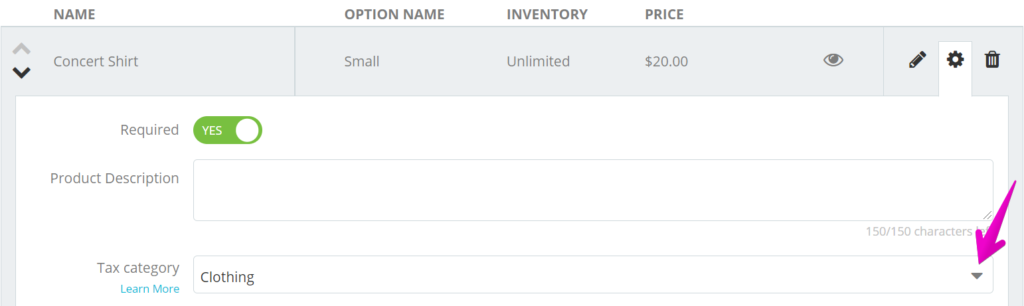

2. Fill in the purchase fields, and then open the Advanced Settings by clicking on the gear icon to select your Tax Category. *for extra description and examples of the tax categories, please refer to the Tax Category Chart below.

3. SAVE all changes.

Custom Tax Settings

1. Go to EVENT DETAILS in the left-side navigation, and then Settings.

2. In the Taxes section simply toggle Add tax to the price of Registration/Tickets to YES. Then type in the TAX NAME, the PERCENTAGE and select which Registrations/Tickets it APPLIES TO.

3. If any of your Purchases are taxable, you can toggle on Add tax to the price of additional purchases for this event. Then type in the TAX NAME, the PERCENTAGE and select which Purchases it APPLIES TO.

4. SAVE all changes.

Tax Category Chart

| Tax Category | Description | Examples |

| Admissions – Performing Arts | Ticket for admissions to concerts, theatrical performances, opera, and recitals. | 1. Tickets for an operatic performance; 2. Tickets for community theatre plays; 3. Tickets for concerts |

| Admissions – No Entertainment or Amusement | Ticket for admissions that do not include entertainment or amusement | 1. Ticket for community event that does not include rides |

| Admissions – Entertainment or Amusement | Ticket for admissions that include entertainment/ amusement | 1. Tickets to a state or local fair that includes rides |

| Beverages (Non-alcoholic) | Ready-to-drink beverages (non-alcoholic) | 1. Soft drinks; 2. Iced tea or lemonade; 3. Fruit punch |

| Beverages (Beer) | Ready-to-drink beer/hard ciders | 1. Beer by the glass; 2. Hard lemonade/Hard soda; 3. Hard ciders |

| Beverages (Wine) | Ready-to-drink wine | 1. Wine by the glass |

| Beverages (Hard Liquor) | Ready-to-drink liquor and cocktails | 1. Mixed drinks: Margaritas/ Martinis; 2. Shots of alcohol |

| Charity Donation | Any item/monetary amount being donated to charity | Any item/monetary amount being donated to charity |

| Clothing | General Clothing Items | 1. T-shirts; 2. Pants; 3. Jackets/Hoodies |

| Default – Any item not categorized | Any item not categorized | Any item not categorized |

| Food | Ready-to-eat food | 1. Sandwiches; 2. Burritos/Wraps; 3. Desserts: Cakes/Pies |

| General Tangible Items | Any physical item that you sell not listed in another category | 1. Bumper stickers; 2. Keychains; 3. crafts |

| Hats & Caps | Hats/baseball caps for sale | 1. Baseball cap; 2. Visors |

| Parking | Charges for parking a vehicle | 1. Parking within a garage/lot; 2. Bike rack rental |

| Rent- Space in a Facility | Rental/Lease of Commercial Property | 1. Rental of booth at a craft fair or flea market; 2. Rent of space in a building for an event (does not include guest rooms in a hotel) |

| Rented Tangible Property | Short-term rental of property | 1. Renting golf clubs for a golf tournament; 2. Rent of museum handsets |

| Shipping and Handling | Shipping and handling charges for items to be shipped to customer, whether at the event or to another address of the customer’s choosing | 1. Shipping and Handling cost; 2. Delivery fee for courier/third-party delivery |

| Transportation | Transportation Services – does not include monies to be deposited to pay for a group bus charter | 1. Bus seat; 2. Ride-share service; 3. Taxi service |

| Water | Individual Bottles of Water | 1. Aquafina |

As we roll out our new sales tax system, we will be listening to your feedback and concerns. Events.com will calculate, collect and file sales taxes due on your behalf. However, and most importantly, Events.com does not provide tax, legal or accounting advice; if you have questions about the implications and effects of our new sales tax system on your business, you should discuss these concerns with your tax professional and/or a tax attorney. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Events.com makes no representations, warranties, or assurance as to the accuracy, currency or completeness of the information provided in this email. Accordingly, you are solely responsible for any inaccuracies, late fees, interest payments, and other tax implications that arise due to such tax system. As such, you agree to indemnify and hold harmless Events.com and its Providers and each of their respective current and former directors, officers, founders, employees, agents, assigns and any other person for whom it is in law responsible from and against any and all expenses, damages, claims, suits, losses or actions (“Claims”) brought against Events.com and its Providers, including but not limited to Claims with respect to such Sales Tax decisions, charges, fees, and implications. You will be automatically enrolled in Events.com’s tax system and authorize Events.com to calculate and pay your sales taxes on your behalf. If you wish to opt-out of such system, please or contact Events.com at help@events.com.